- TPS Group

- Articles

Are You Getting Good Customer Service from Your TPA? Six Key Questions

Posted on Feb 4, 2020

A competent TPA relieves an employer of the day-to-day processes involved with a retirement plan, and ensures the plan is in compliance with state and federal law. But are you confident that you’re getting good customer service from your TPA? Evaluate your TPA’s performance with these six questions.

Continue readingYour World Evolves and Your Retirement Plan Should, Too

Posted on Jan 23, 2020

Any of these changes may have implications for your retirement plan and how it benefits you and your employees. Our goal is to make sure your plan takes advantage of the latest tools and design options to optimize its potential and performance for you. So, if there’s anything new in your world, let’s talk.

Continue readingHow a Cash Balance Plan Works

Posted on Jan 20, 2020

Each participant has a hypothetical account balance which grows annually in two ways: first, a principal credit, which is a contribution usually defined as a percentage of pay, and second, an interest credit, which can be guaranteed rather than dependent on the plan’s investment performance.

Continue readingUnderstanding How Forfeitures Work in Your Retirement Plan

Posted on Jan 14, 2020

When we talk about 401(k) retirement plans, we sometimes focus on the contributions made by employees that are always immediately vested. In other words, it's their money and they can always withdraw it without forfeiting any - subject to certain IRS rules about early withdrawals.

Continue readingIs One Toke Over the Line? What Employers Should Know about Weed at Work

Posted on Jan 3, 2020

As more and more states legalize marijuana for medical and recreational use, employers are increasingly faced with legal questions about their drug-free workplace policies, including pre-employment drug screening.

Continue readingSexual Harassment Training in CT: Are Employers Prepared?

Posted on Dec 13, 2019

As of October 1, 2019, a new law called the “Time’s Up Act” significantly expands sexual harassment training requirements for Connecticut employers. Previously, only employers with 50 or more employees were required to provide sexual harassment training to managers and supervisors.

Continue readingIt’s Time to Restate Your Defined Benefit Plan Document

Posted on Dec 5, 2019

Your Defined Benefit plan is modeled on a pre-approved prototype or volume submitter document that’s part of a cycle that must be restated every six years. It’s important to know that the deadline to restate your plan is April 30.

Continue readingEncourage Greater Participation with a QACA Safe Harbor

Posted on Nov 22, 2019

To avoid uncertainty about nondiscrimination tests as you—a company owner—maximize your own retirement savings, you can choose to make additional contributions for your employees. These contributions give you a free pass on these tests. They’re called “Safe Harbor” contributions.

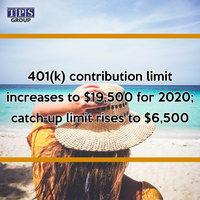

Continue readingIRS Announces 2020 Pension Plan Limitations

Posted on Nov 18, 2019

The Internal Revenue Service announced that employees in 401(k) plans will be able to contribute up to $19,500 next year.

Continue readingManaging Millennials: What Employers Need to Know

Posted on Nov 11, 2019

For many workers of the Baby Boomer generation, working long hours and leaving vacation time on the table is not uncommon. A 2016 Bankrate survey found that more than half of Americans with paid time off leave a minimum of seven days of vacation time unused each year.

Continue reading