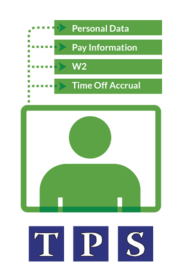

Save Time! Employee Self-Service will provide you with the most up-to-date and cost effective method of distributing payroll information to your workforce. Employee Self-Service gives your workforce access to pull personal data, pay information, W2s and time off accrual information securely via the internet. This "paperless payroll" system will allow you to reduce routine inquiries from employees, provide your employees with greater access to payroll information, and ease the burden of distributing payroll vouchers to your workforce.Call 1-855-828-2229 to setup a demo!

- TPS Group

- Services

- Payright Payroll Affiliates

- Employee Self-Service

Employee Self-Service

Save Time! Employee Self-Service gives your workforce access to pull personal data, pay information, W2s and time off accrual information securely via the internet.

Related to: Payroll Provider, Payroll Processing

Reviews

The Latest News

The 401(k) Match True-Up to Help Employees Get the Full Match

Posted on Feb 15, 2026

Matching contributions are one of the most valuable benefits in a 401(k) plan — and employees often plan their savings strategy around getting the full match. But there’s an overlooked detail in many plans that can unintentionally reduce the match for certain participants: how the match is calculated during the year. »

Rescuing a Forgotten 401(k): How to Track Down and Reclaim Your Old Retirement Accounts

Posted on Nov 5, 2025

It’s surprisingly easy to lose track of a 401(k) when you change jobs. In fact, millions of Americans have “orphan” accounts, which are small retirement balances left behind at former employers. »

Why Every Employee Should Check Their 401(k) at Least Once a Year

Posted on Oct 8, 2025

It’s easy to set up a 401(k) and then forget about it, especially when life gets busy. But the “set it and forget it” approach can cost you over the long term. Checking your 401(k) at least once a year ensures your retirement savings stay on track and aligned with your goals. »