Posted on Jan 11, 2022

This notice explains how you may be able to pay less tax by contributing to your Employer’s Plan or to an individual retirement arrangement (“IRA”).

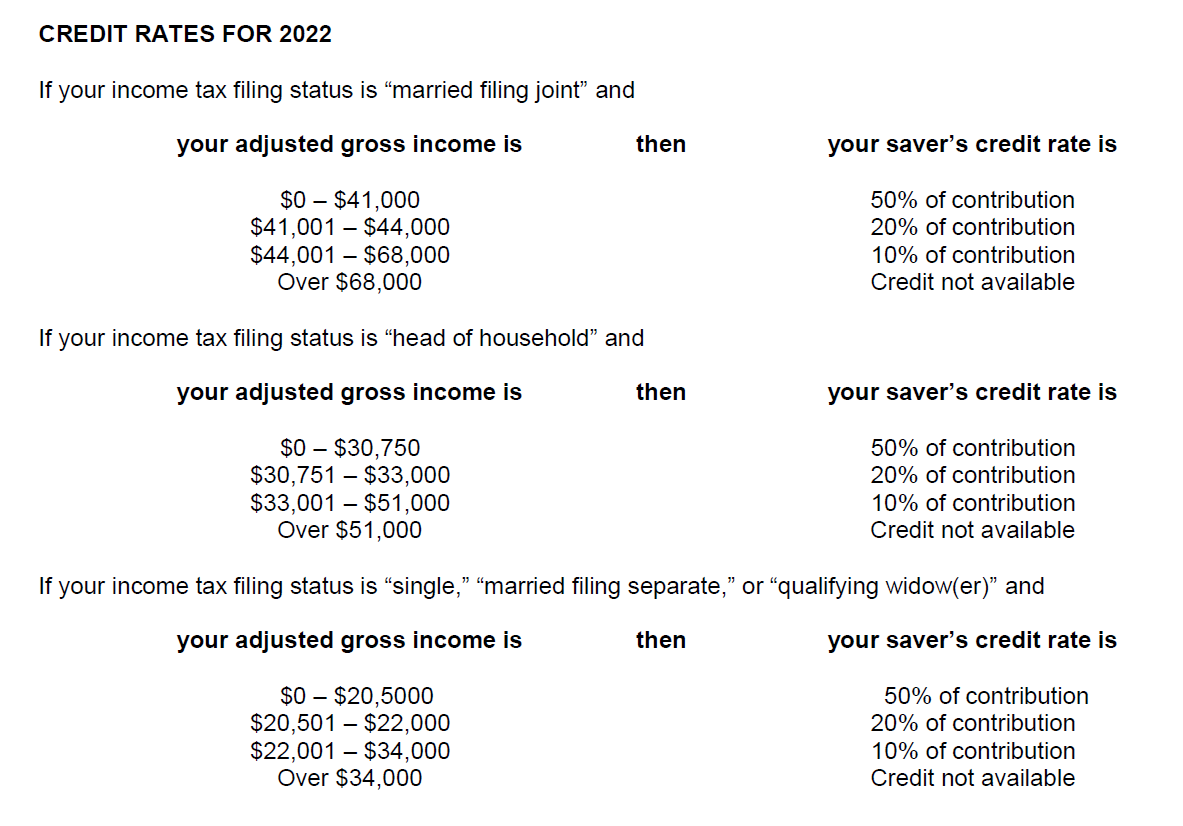

If you make contributions to the Plan or to an IRA, you may be eligible for a tax credit, called the “saver’s credit.” This credit could reduce the Federal income tax you pay dollar-for-dollar. The amount of the credit you may receive is based on the contributions you make and your credit rate. The credit rate can be as low as 10% or as high as 50%, depending on your adjusted gross income ― the lower your income, the higher the credit rate. The credit rate also depends on your filing status. See the tables at the end of this notice to determine your credit rate. The maximum contribution taken into account for the credit for an individual is $2,000. If you are married filing jointly, the maximum contribution taken into account for the credit is $2,000 each for you and your Spouse.

The credit is available to you in 2022, if you:

- are 18 or older,

- are not a full-time student,

- are not claimed as a dependent on someone else’s return, and

- have adjusted gross income (shown on your tax return for the year of the credit) that does not exceed:

- $68,000 if you are married filing jointly,

- $51,000 if you are a head of household with a qualifying person, or

- $34,000 if you are single or married filing separately.

The annual contribution eligible for the credit may have to be reduced by any taxable distributions from a retirement plan or IRA that you or your Spouse receive during the year you claim the credit, during the 2 preceding years, or during the period after the end of the year for which you claim the credit and before the due date for filing your return for that year. A distribution from a Roth IRA that is not rolled over is taken into account for this reduction, even if the distribution is not taxable. After these reductions, the maximum annual contribution eligible for the credit per person is $2,000. The amount of your saver's credit will not change the amount of your refundable tax credits. A refundable tax credit, such as the earned income credit or the refundable amount of your child tax credit, is an amount that you would receive as a refund even if you did not otherwise owe any taxes. The amount of your saver's credit in any year cannot exceed the amount of tax that you would otherwise pay (not counting any refundable credits or the adoption credit) in any year. If your tax liability is reduced to zero because of other nonrefundable credits, such as the Hope Scholarship Credit, then you will not be entitled to the saver’s credit.

Saver's Credit Rates for 2022