Posted on Jan 20, 2020

How a Cash Balance Plan Works

Each participant has a hypothetical account balance which grows annually in two ways: first, a principal credit, which is a contribution usually defined as a percentage of pay, and second, an interest credit, which can be guaranteed rather than dependent on the plan’s investment performance.

History & Basic Structure of a Cash Balance Plan

Started in 1985, approved prospectively by IRS in Pension Protection Act of 2006 (PPA), final regulations passed in October of 2014.

A hypothetical account balance is established for each participant, as follows:

- Employer funded, pooled assets, trustee/advisor directed investments, required annual contributions.

- Payable as a lump sum at retirement or termination (annuities also available).

Advantages of a Cash Balance Plan

- Large tax deductions.

- For the company, money contributed to the plan is tax-deductible now.

- For participants, taxation on benefits is deferred until received as income.

- Accelerated retirement savings for Owners and Key employees.

- Can vary contribution by owner.

- Easy to understand, straight forward hypothetical account balance.

- Employer’s liability is easily defined.

Ideal Candidates For a Cash Balance Plan

- Businesses demonstrating consistent cash flow and profits.

- Professional practices such as Doctors, Dentists, Attorneys.

- Family Businesses.

- Sole proprietorships (owners with younger employees, or any age if no employees).

- Partnerships with varying goals and needs among the partners.

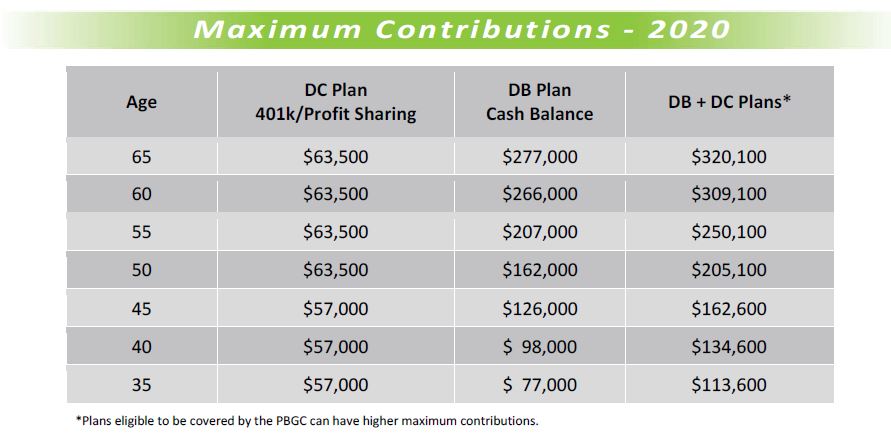

- Owners who desire to contribute more than DC plan permits.

1. Can Cash Balance plans be offered in addition to 401(k) Profit Sharing plans?

Yes, the employer can offer a combination of qualified retirement plans in order to produce a larger contribution.

2. What are the distribution options upon retirement or if leaving the employer?

Any vested account in a Cash Balance Plan can be paid a lump-sum distribution or annuity. Lump sums are usually rolled over to an IRA.

3. Must everyone participate equally in the Cash Balance plan?

No. Each participant can have a different contribution level.

4. Can Cash Balance contributions change?

Yes, but with restrictions. In addition, a plan can be frozen or terminated.

5. Is the plan subject to IRS nondiscrimination testing?

Yes, like any other qualified plan, a Cash Balance Plan is subject to annual nondiscrimination testing.

6. How do design and administrative costs compare with 401(k) Profit Sharing plans?

They are higher because the plan is maintained by an actuary who certifies each year that the plan is in compliance with the Internal Revenue Code.

Back to Blogs Helpful Resource Links