Posted on May 17, 2018

Bill and Sue, a married couple seeking advice from their financial advisor, felt that they were in a quandary. At age 62, Bill wanted to retire within the next year. Sue, at age 59, had scaled back from full-time work to a part-time position due to health problems. Neither had pensions, but both had been contributing for years to their 401(k)s, and were close to reaching their savings goal. Their pressing concern was when each should apply for Social Security. If Bill left his job at 63, should he wait until his full retirement age to begin collecting? What were their options with early filing, standard filing, delayed filing, and spousal benefits? In short, what was the best strategy to maximize their income? The more Bill and Sue researched this topic on their own, the more questions they had and the more confused they became.

In fact, when to claim Social Security is a critical financial decision for most people nearing eligibility. It is also a complicated decision, as there are literally hundreds of claiming options available. Many people are unaware of all of the options and benefits that are available to them. The consequence could be thousands of dollars in unclaimed benefits and potentially, a lower quality of life during retirement.

Calculation of lifetime benefits, income before and after retirement, tax consequences, marital status, and life expectancy are some of the factors that must be considered. Yet, many Americans make their filing choice impulsively and emotionally, without professional guidance as to how their decision will impact their future income, and the future income of a spouse. Myths and misunderstandings abound. For example, many people think the best retirement strategy is to take reduced Social Security payments as soon as they are available, at age 62. However, unless a person is seriously ill, the fear of dying early and losing out on benefits is often misplaced. For women, the factors to weigh are even more critical since they outlive men, on average, tend to have less money saved for retirement, and less income from Social Security.

Since its inception in 1935, Social Security has evolved into an incredibly complex system, with 2,728 rules (and their exceptions and variations), along with tens of thousands of rules in its Program Operating Manual System (POMS). Understanding and keeping abreast of changes in the law would be challenging enough for financial advisors, experts in investments and money management, never mind the average person. So how is one to make an informed decision or provide guidance to others?

Unique technology The Pension Service (TPS) uses is Nationwide Retirement Institute’s Social Security 360℠ program. TPS has worked with Nationwide for many years and is familiar with its products and services. Social Security 360℠ offers easy-to-understand educational materials, client and advisor seminar materials, and Social Security planning tools, including the Social Security 360 Analyzer. Educational resources include topics such as the basic rules and options for Social Security planning, considerations for public sector employees, explanation of widow benefits, how working affects benefits, and much more.

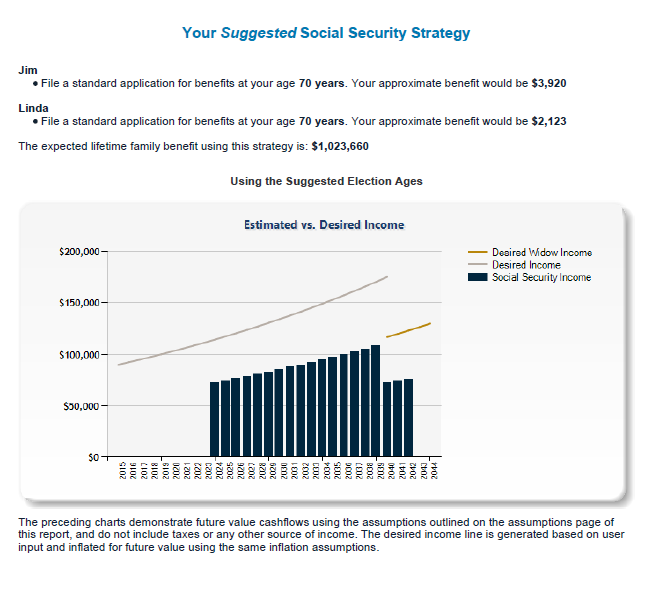

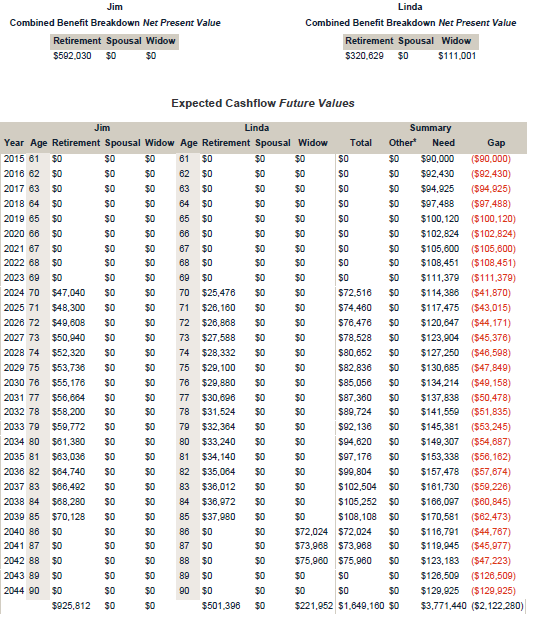

The online Social Security 360 Analyzer tool is especially useful, as it helps advisors analyze and present Social Security options to clients, including personalized filing strategies, and break-even and cash flow analyses. Clients first complete a questionnaire that gathers relevant information, such as how much income they desire to have each year in retirement. The customized report that is generated provides a suggested Social Security plan strategy. Example 1 shows a chart for a suggested Social Security strategy for a fictional couple named Jim and Linda, who each file for benefits starting at age 70. This chart demonstrates the gap between Social Security income and the couple’s desired income. (It does not show other sources of income the couple may have in retirement.) The Social Security 360 Analyzer tool also shows first and second alternate claiming strategies, break-even points, earliest possible election ages and the estimated cash flows for each option an individual or couple chooses. In Example 2, the report shows expected cash flows for the same fictional couple, demonstrating the gap between expected earnings and the couple’s desired earnings. These charts provide information people need to better plan for retirement, and may also serve as an impetus to save more in their 401(k) plans. The Analyzer tool also explains the distinct types of benefits for retired workers and/or their spouses, common terminology, and different techniques that can be used to optimize benefits.

With 46% of the workforce in private industry lacking private pension coverage[1], Social Security benefits can represent a significant percentage of retirement income for many clients. It is one of the most important topics on the minds of people planning for retirement. The Pension Service has found that while employee attendance tends to be low to average at 401(k) plan enrollment and education meetings, attendance at educational seminars on Social Security is consistently high. It is a topic of great interest to employees. Moreover, participants are more likely to take advantage of the opportunity for advanced planning.

Other advantages of this technology include the following:

- The ability to offer seminars, educational materials and customized reporting provides financial advisors with a competitive advantage. Clients who don’t receive information on Social Security benefits from their advisors are likely to take their business elsewhere.

- When participants gain a better understanding of the Social Security system and how it relates to their own retirement planning, they are more likely to feel engaged in the process. Engagement leads to consistent and sometimes higher contributions, better plan retention, and a better user experience overall.

- Social Security 360℠ personalized reports provide a comprehensive roadmap for clients, outlining their options for the future while clearly demonstrating the financial ramifications for each choice. While no tool can offer 100% certainty regarding outcomes, the reports are a springboard for further discussion. The charts and graphs offer a compelling visual to help clients understand how different strategies vary in terms of monthly and cumulative income.

- The resources and tools provide broad support for answering Social Security questions and developing income plans. Making an uninformed decision about filing for Social Security can make a difference of potentially hundreds of thousands of dollars in lost retirement income.

Advisors look to The Pension Service and often depend on them to be knowledgeable about retirement planning tools and resources. Given our 50+ years in business, we are very familiar with the tools and resources offered by many of the 401(k) record-keepers in the industry. It is in everyone’s best interest for employees to understand the key concepts related to their retirement planning and be fully informed about their options well in advance. Since each person’s situation is different, personal attention is critical. The financial decisions made about Social Security require careful thought and analysis and will likely impact the quality of life in retirement.

Using the best available tools to help clients make informed decisions offers them – and you – greater peace of mind. Nationwide Retirement Institute’s program offers the opportunity for advisors to present difficult financial planning concepts to clients in understandable terms, increase their Social Security literacy, and ultimately, make the best possible choices about their financial future.

Example 1:

Example 2:

Social Security 360 SM and Social Security 360 Analyzer SM are service marks of Nationwide Life Insurance Company. Nationwide's Social Security 360 Analyzer SM is provided for informational purposes only.

About Phil Coco: Phil Coco, Vice President of Sales and Marketing, has spent over 15 years with the TPS Group managing sales and marketing for all of their offices and working with financial advisors to deliver solutions-based retirement programs to their clients. He holds a Bachelor of Science degree in Business Communication from Keene State College in New Hampshire.

Back to Blogs Helpful Resource Links