- TPS Group

- Articles

What Keeps Plan Sponsors Up at Night?

Posted on Oct 3, 2019

Plan sponsors have a lot on their plates. At the 2019 National Association of Plan Advisors (NAPA) Summit, a panel of plan sponsors expressed their chief concerns, from participation rates to compliance. Following is a summary of the top 9 issues.

Continue readingDid You Know You Are a Fiduciary?

Posted on Sep 23, 2019

We suggest reviewing the fiduciary status of all service providers to whom you've outsourced some or all of your plan oversight tasks. This may reveal issues to be addressed and will certainly provide more clarity in your understanding of your fiduciary role and responsibilities.

Continue reading401(k) Plans: A Win-Win for Employers and Employees

Posted on Sep 11, 2019

If you’re an employer and don’t offer a 401(k) plan, you could be missing out on key benefits for you and your business. First, offering a 401(k) helps to attract and retain valued employees.

Continue readingThe Loan They Never Take May Make All the Difference

Posted on Aug 7, 2019

Loans are meant to be repaid, of course. Hardship withdrawals, by contrast, are not. They are allowable early withdrawals and absolutely reduce an employee’s retirement account balance.

Continue readingIt’s a Juggling Act: How to Save for Retirement and Still Pay Your Bills

Posted on Jul 26, 2019

When you’re in your twenties and thirties, retirement seems like a long way off. Steve and Kim, both Millennials with a new house, two cars, and a baby on the way, could barely fathom how they would meet all the financial responsibilities of being homeowners and soon-to-be parents, much less save for retirement

Continue readingAuto Enrollment and Auto-Escalation

Posted on Jul 11, 2019

Saving for retirement takes time and perseverance. And, the need to start saving as early as possible is clear. So how can you help your employees get started saving and establish a disciplined savings path toward retirement?

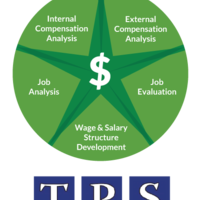

Continue readingDangers of not using accurate data for compensation benchmarking

Posted on Jul 1, 2019

Accurate compensation benchmarking helps organizations maintain a competitive edge, ensure equitable and defensible pay practices, and comply with wage and hour laws. Compensation benchmarking is key to making data-driven decisions regarding what is likely the organizations largest expense Most organizations spend around 80% of gross revenue on employee compensation and benefits.

Continue readingRecordkeeper/Administrator Renews Certification To Industry Best Practices

Posted on Jun 20, 2019

CEFEX, Centre for Fiduciary Excellence, LLC, has renewed the certification of TPS Group, headquartered in North Haven, CT as adhering to the American Society of Pension Professionals & Actuaries (ASPPA) Standard of Practice for Retirement Plan Service Providers

Continue readingShould You Refinance Your Student Loans?

Posted on Jun 10, 2019

If you’re struggling to pay down your student loans, you’re not alone. About 44.7 million Americans carry student loan debt, with an average monthly payment of $393.00[1] It’s a hefty sum, especially if you’re fresh out of school and not making a high salary. With an average debt balance at just under $30k, recent graduates face years of payments and as a result, may postpone marrying, buying a home or other large purchases, saving for retirement, or starting a business.

Continue readingWhen to Set Sail with Safe Harbor

Posted on May 30, 2019

Many company owners actively seek to maximize their 401(k) contributions each year. That’s a great goal, but it can be problematic if your plan fails to meet the nondiscrimination rules. Adding a Safe Harbor provision can confidently address this issue while providing important benefits to your company and employees.

Continue reading